Our Community

We are a community founded on uplifting shared values. Our staff and volunteers work to provide the passionate care and spiritual guidance that our values and faith inspire.

Concordia’s Values

We uphold our Christian values while meeting the needs of seniors of all beliefs through a safe, secure and supportive community. This mission informs our dedication to service for all residents living at Concordia.

Be W.I.S.E.

Our values are represented in simple acts of goodwill that provide a consistent, positive impact in our community:

- Wear a smile

- In all things honor God

- Serve others before yourself

- Encourage and bless others

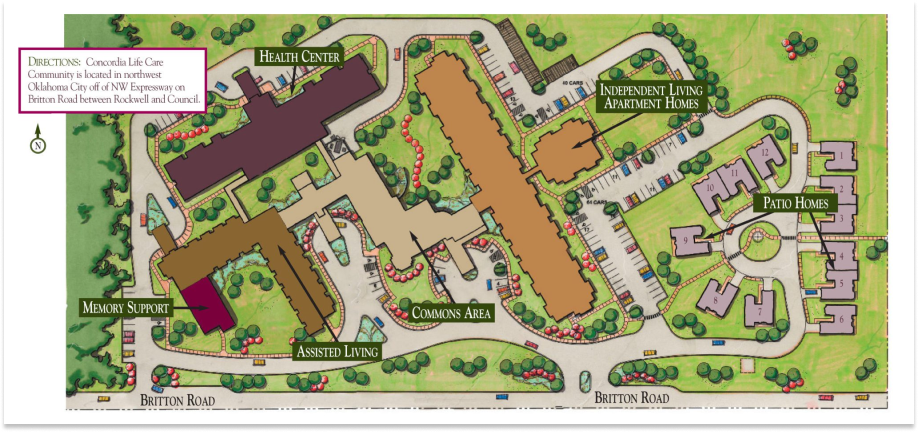

Comfort and City Living

Our location in northwest Oklahoma City is just a stone’s throw away from countless shops, restaurants and local businesses that residents can access from the calm comfort of our 15-acre community.

Benefits of senior living in Oklahoma City include:

-

- A low cost of living (almost 14% below the national average)

- Gorgeous weather and outdoor recreation

- Retiree programs offered by the state’s 50 universities

- Enriching and fun experiences to share with family and friends

- OKC Zoo

- Festival of the Arts

- Myriad Botanical Gardens

- Oklahoma City Museum of Art

- OSU-OKC Farmers Market

Founded in Faith

Ministry Sponsors

Concordia honors the sponsoring ministries aiding our mission in Oklahoma.

LCMS Oklahoma District

www.oklahomalutherans.org

https://www.lcms.org/

Christ Lutheran Church

501 N. Clear Springs Rd, Mustang, OK 73064

Phone: (405) 376-3116

Daniel Ross, Pastor

www.christlutheranmustang.org

Faith Lutheran Church

2512 S. Shartel, Oklahoma City, OK 73109

Phone: (405) 632-5744

Good Shepherd Lutheran Church

700 N. Air Depot, Midwest City, OK 73110

Phone: (405) 732-2585

Ron Simpson, Pastor

https://gslcmwc.com/

Immanuel Lutheran Church

1800 NW 36th St, Oklahoma City, OK 73118

Phone: (405) 525-5793

Clinton McMullin, Pastor

Lutheran Church of Our Savior

6501 NW 23rd St, Bethany, OK 73008

Phone: (405) 495-1605

Gary Rohwer, Pastor

www.oursaviorokc.org

Zion Lutheran Church

7701 West Britton Rd, Oklahoma City, OK 73162

Phone: (405) 722-7472

Ron Christie, Pastor

zionluthokc.360unite.com

Frequently Asked Questions

What Is Concordia’s Mission Statement?

Who Operates Concordia?

Concordia Life Plan Community is owned by Lutheran Senior Citizens, Inc., a 501(c)(3) not-for-profit organization organized with the purpose of providing senior housing and related services in the vicinity of Oklahoma City.

What is Lutheran Senior Citizens, Inc. (LSCI)?

LSCI was organized in 1959 for the purpose of providing senior housing and related services and continues to be committed to meeting the needs of Oklahoma City seniors.

How Does Concordia Help Local Communities?

- Villages OKC

- Senior Living Truth Series Education Partner

- Trash pick-up

- DOH education

- Special Olympics

- Hugs

- The ROC

- Junior League

- OHA

- Parkinson’s Alliance

- Alzheimer’s Association

How Do Concordia’s Mission and Faith Improve the Lives of Residents?

Our spiritual anchor sets our high standards for service. Our staff’s spiritual and moral character compels them to a quality of care that is evident to Concordia residents each and every day.

People With a Passion for Life Planning

Our community is a family, and it wouldn’t be complete without the dedicated members of our staff. Get to know the friendly faces of Concordia’s leadership and board of directors.

7707 W Britton Rd

Oklahoma City, OK 73132

Phone: (405) 331-6113

Toll-Free: 1 (888) 489-0075

Fax: (405) 621-8701

Living Options

Our Community

Becoming a Resident

Foundation

Contact